PlanPay, has expanded into the event sector, opening its doors to luxury event space Greenfields Albert Park, becoming the first dedicated event venue in Australia to offer their new agent checkout to clients.

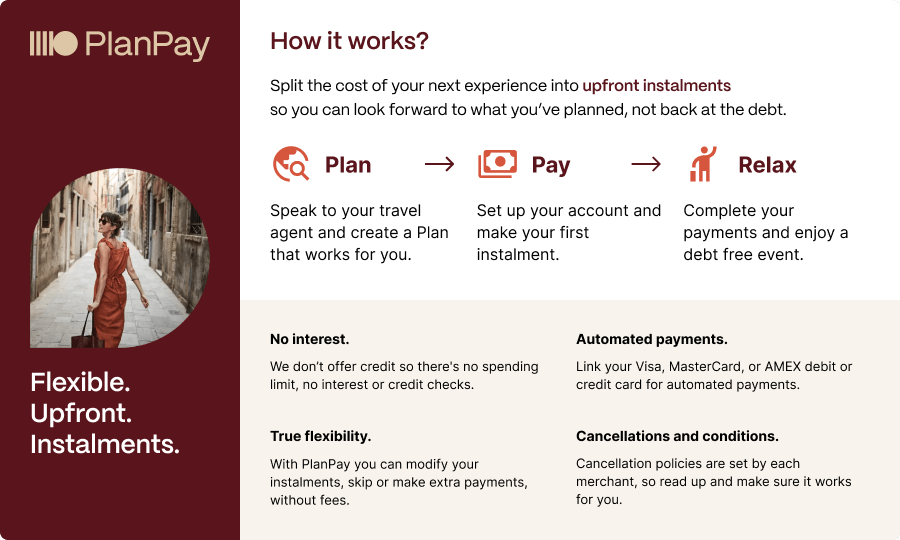

As we all know, the cost of living pressures continue to rise, and household budgets are under scrutiny. With the introduction of PlanPay’s new payment option, clients at Greenfields Albert Park can now split the cost of their weddings, birthdays and other celebratory events into flexible upfront instalments.

The integration-free agent checkout provided by PlanPay has been designed to facilitate over-the-phone and face-to-face sales. Clients can work closely with their event advisors, create a bespoke payment plan, and divide the cost into weekly, fortnightly, or monthly payments before their event.

By ensuring these instalments are paid upfront clients can avoid credit checks and filling out lengthy approval forms required by other payment methods, removing any friction from the sales process, leading to more on the spot bookings.

Thanks to PlanPay, customers can now secure their event date up to two years in advance without relying on credit facilities. This means they can fully enjoy their celebrations without the stress of looming debt.

By working with PlanPay you are able to maximise your average booking value, all while reducing financial barriers for clients looking to set the date for their milestone moments.

The integration-free system also eliminates the administrative burden of chasing payments, allowing event advisors to focus more on building strong client relationships and turning dream events into a relaxing reality.

The launch of PlanPay’s agent checkout not only benefits event venues like Greenfields but also opens up opportunities for travel agents and tour operators to offer flexible prepaid instalments to their customers, ensuring they avoid any financial hangovers.

PlanPay offers a range of benefits for merchants, including:

– Increase average order value: affordability is the number one problem for customers right now, PlanPay research shows, 41% of customers would be more likely to upgrade, when paying with instalments.

– Gain longer booking lead times: Gain a 10-month average lead time when using PlanPay compared to just weeks with credit card payments.

– Seamless integration into ecommerce checkouts or our zero-integration agent platform: Our simple and customisable set up means you can be reaping the benefits of PlanPay in no time.

– Grow your retention by engaging customers with payment flexibility: With PlanPay, merchants can deliver financial freedom to their customer base.

– Easily retarget abandoned carts: Unlike traditional payment methods, PlanPay gives a pricing incentive without discounting.

PlanPay’s growth in the event sector has already seen great success, with Greenfields joining other leading brands like The Ovolo Group and RoomStay, who are currently offering PlanPay’s online checkout integration, and EVT brands like QT, Rydges, and Atura, which will be available later this year.

PlanPay offers merchants the ability to become more accessible and financially sustainable for clients, making dreams come true without the burden of debt, helping many more Australians plan more of their events at some of Australia’s best hotels.