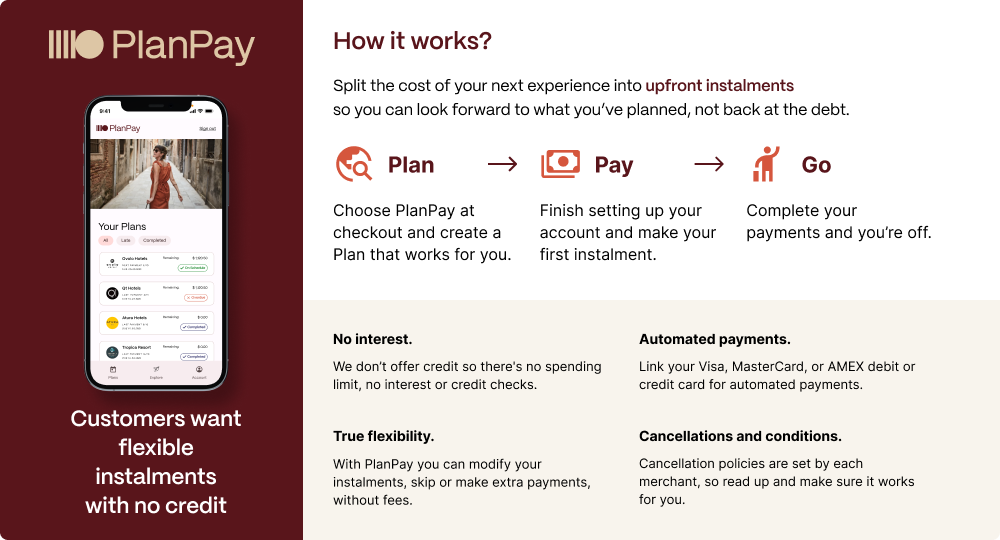

If you didn’t already know about PlanPay, where have you been hiding? PlanPay hit the market earlier this year with its digitised layby platform which allows customers to avoid the pitfalls of debt while keeping the highly desirable convenience of instalments.

With multiple reports showing the impacts of the cost-of-living crisis and the push for flexible payments soaring, PlanPay offers a seamless PayTech solution that is purpose-built for the travel industry.

Despite the pressures of inflation, customers are still looking for ways to have high-end get aways on a budget. Using PlanPay, customers can create bespoke payment plans, dividing the cost into weekly, fortnightly, or monthly payments prior to their holiday and align their payment date with their pay cycle. This gives customers the ability to budget and plan for their trip ahead of time, rather than being caught out by the bills that come afterwards.

Since its launch, PlanPay has demonstrated its value to customers, with some travellers utilizing the platform up to 18 times. This high level of customer engagement demonstrates the platform’s effectiveness in meeting their needs for flexible and manageable payment options.

By choosing to pay in upfront instalments, guests are locking in their bookings far earlier than with BNPL or credit cards, in fact on average up to 291 days in advance with PlanPay versus just 59 days with other payment options. We also see the average spend using PlanPay has a 4.1x higher order value than the average BNPL spend and 1.5x more than paying with debit or credit cards.

Benefits for Merchants: PlanPay offers several advantages for merchants, providing them with the tools to enhance their businesses and cater to the evolving needs of their customer base:

PlanPay offers a range of benefits for merchants, including:

– Seamless integration into ecommerce checkouts and agent platforms: Our simple and customisable set up means you can be reaping the benefits of PlanPay in no time.

– Gain longer booking lead times: Gain a 10-month average lead time when using PlanPay compared to just weeks with credit cards payments.

– Grow your retention by engaging customers with payment flexibility: With PlanPay, merchants can deliver financial freedom to their customer base.

– Easily retarget abandoned carts: Unlike traditional payment methods, PlanPay gives a pricing incentive without discounting.

– Increase direct bookings and average order value: PlanPay research shows, 41% of customers would be more likely to upgrade, when paying with instalments. Merchants can utilise PlanPay to increase lead times and provide a pricing incentive that can replace discounting.

By displaying their prices in weekly instalments merchants can drive conversion, reduce abandon carts, increase order values, and reduce the cost of customer acquisition by making direct bookings more appealing.