The recovery of the tourism sector to levels similar to 2019 may take until 2022 at the earliest to be fully realised, according to the first in a new series of reports released today by the Accommodation Association (AA).

The report, entitled ‘Australian Hotel Industry Sentiment Survey, Impact of COVID19’, comes as part of a partnership between the Association, AHS Advisory and Horwath HTL. The initial results canvassed in the maiden results draw on 90 responses to a survey distributed recently among the Accommodation Association’s member base which assess the industry’s response to the government assistance provided to date in response to the impact of COVID-19. The 90 respondents correlated to around 15,160 rooms across various market sectors in Australia, with responses mixed across the Luxury, Upper Upscale and Upscale segments.

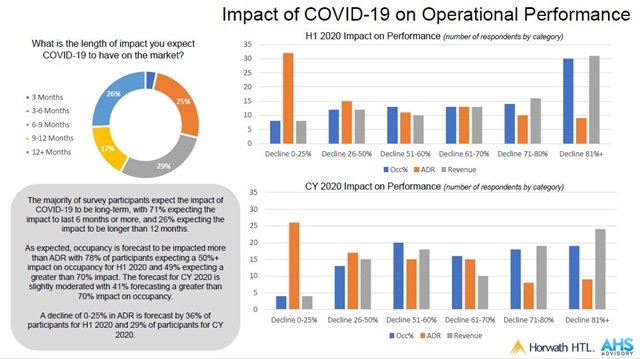

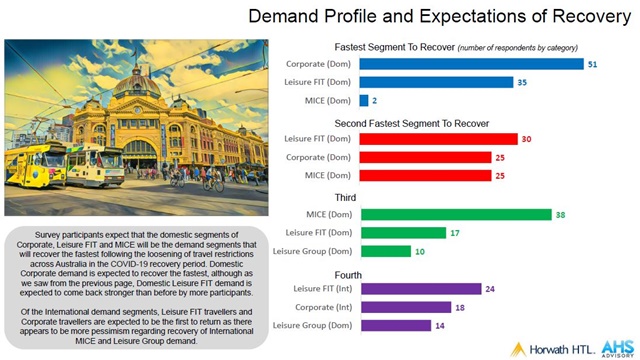

According to the survey results, most respondents believe the effects of the virus to be long-term, with a “bleak” outlook expected for the rest of Q2 and Q3. The final quarter of the year may see some improvement based on how governments wind back movement restrictions and drive demand for domestic travel, with domestic corporate, leisure and MICE expected to be the fastest to recover.

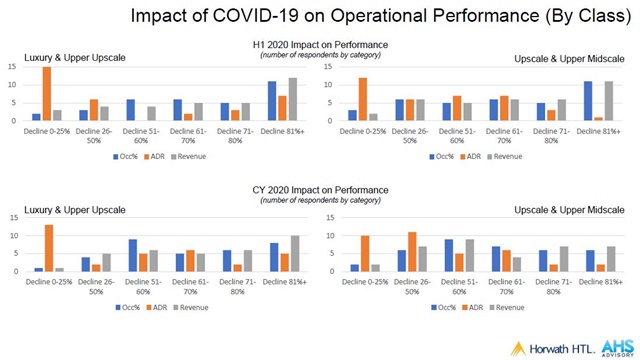

Over a calendar year outlook, the biggest hit to Average Daily Rate (ADR) is expected by hoteliers operating in the Luxury and Upper Upscale category, the study found, compared to Upscale and Upper Midscale properties. The majority of hoteliers believe the impact of COVID-19 will impact ADR to the tune of between zero and 25%, while bigger hits of 81% and above will be sustained in terms of revenue and occupancy for at least the first half of 2020. Occupancy in particular is expected to be more than halved until at least the end of the year, according to results.

In a true sign of resilience, a stunning 82% of hotels still operating are planning to remain open – a higher result than what was anticipated. Of those hotels currently closed, most have earmarked the third quarter of 2020 as the targeted reopening period, with only seven seeing Q4 2020 or the beginning of 2021 as the best time to resume trading. In the meantime, the results showed unsurprisingly that nearly every hotel (99% of respondents) said it had implemented some form of cost control measures to help steer it through the downturn. This included measures such as a hiring freeze, suspension of capital expenditure work, mandatory paid leave clearance and headcount reductions.

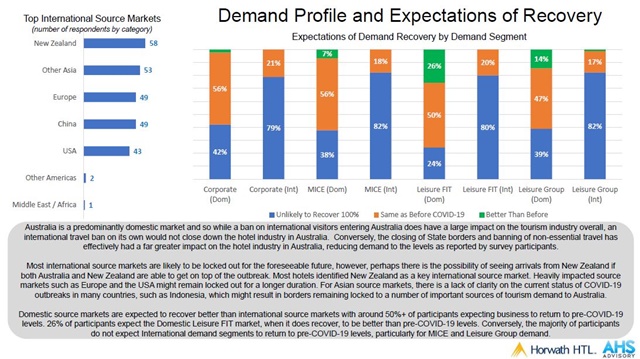

Looking to recovery, Australia is buoyed by the notion it is highly reliant on domestic travel. International travellers make up only 7% of all overnight trips recorded however also accounts for 40% of all hotel room nights booked, making it a strong and highly valued source. In terms of short-term recovery, the prospect of interstate borders reopening and domestic markets bursting back into life sooner than overseas markets is proving a lifeline for hoteliers looking to the future.

The survey found the Domestic Corporate, Domestic Leisure and MICE travel are expected to help hotels kick back into gear faster than waiting for international borders to resume. New Zealand was also viewed as a key international source market and a key player in helping the hotel industry recover sooner if travel restrictions between the two countries was able to resume sooner than other parts of the world.

Accommodation Association CEO, Dean Long, said the sector is looking to put together its road map out of the crisis and ensure it is ready to welcome guests once again as soon as restrictions are lifted.

“If the tourism economy is to emerge from this global pandemic as a strong contributor to the economy, we need to map the road to recovery with Federal and State governments to ensure measures are in place to stimulate confidence and drive demand in the domestic economy, followed by targeted activation of key international markets,” he said.

AHS Advisory Managing Director, Ron de Wit, said the travel and tourism industry in Australia is in an unprecedented situation.

“Hotel owners and operators are currently looking at an empty horizon, uncertain when the first signs of a resumption of business and leisure travel will come into view. While nobody knows the answer to this, we believe that the collective thoughts of the industry can provide some guidance over the coming weeks and months as we all seek to understand the scale of the situation.”

CLICK HERE to read the first report in full.