Dransfield Hotels and Resorts has released the released the 21st edition of the Hotel Futures series with Hotel Futures 2018. They report on major Australian hotel markets during FY2017 with long term forecasts to FY2026. HM has an official extract.

FY2017 Year in Review

In FY2017 the Australian Major Cities Hotel markets recorded 2.1% revenue growth (RevPAR) as occupancy levels increased despite material supply additions, providing a basis for moderate rate growth.

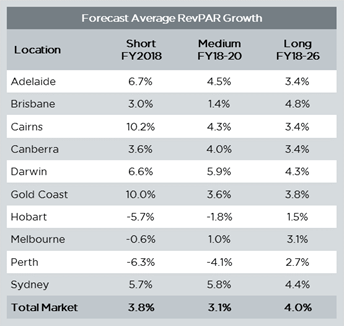

Substantial variance was recorded in individual city performance, with Sydney and Melbourne maintaining their position as the only cities above the national RevPAR average, while Cairns and Canberra are the star performers in terms of growth. Perth, Brisbane and Darwin all continued their reset from abnormal resource project pricing.

Hotel Futures 2018 Snapshot

The Hotel Futures 2018 long term revenue forecast for Australian Major City hotels is for healthy RevPAR growth averaging 4.0% p.a, underpinned by high occupancy levels, and a positive supply and demand equation. Long term growth is expected for all cities, although market cycles differ from city to city.

The forecast represents a slight downgrade to prior expectations impacted by a slightly contracted supply and demand equation, placing less upward pressure on rates. Growth, however, is still strong and well above recent history, which averaged 2.2% p.a. over the last 3 years.

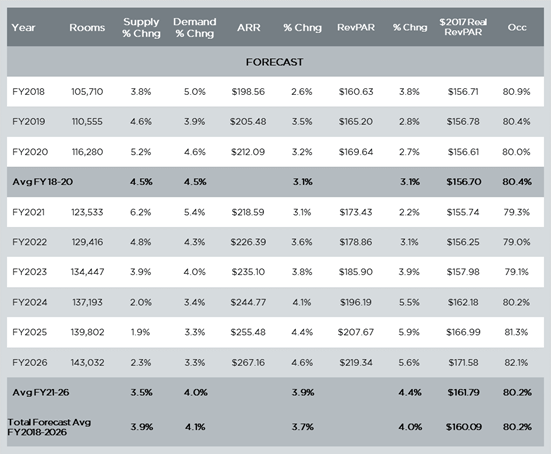

TOTAL AUSTRALIAN MAJOR CITIES (WEIGHTED)

AUSTRALIAN MAJOR CITY HOTEL MARKET REVENUE FORECASTS

Demand Forecast

Demand growth has been upgraded, with 4.1% p.a. growth now expected compared to 3.9% last year. Improved TRA visitor forecasts, greater international access, improvement and diversity in demand drivers across many cities, and enabling supply additions have all contributed to the upgrade. Despite the uplift, demand remains constrained by supply in some markets.

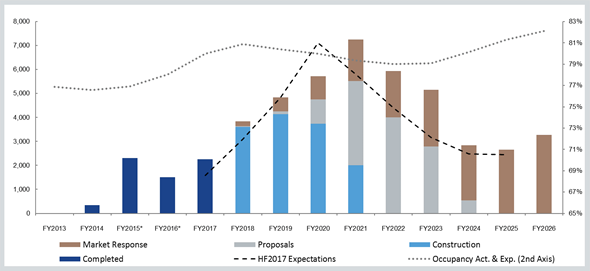

Supply Forecast

Supply expectations represent an upgrade in absolute levels to prior expectations with 3.9% growth p.a. anticipated to FY2026. Improved overarching industry sentiment and an upgraded demand outlook has driven the uplift, with demand expected to fully absorb the additional new supply over the long term.

Highlights include:

• Pipeline certainty has improved as the collective pipeline moves towards the construction peak, with live projects (recently completed, under construction, proposals) increasing to 226 from 166;

• Proposals are also being replaced at a faster rate than delivery, absorbing Market Response Allowances; and

• Despite a maturing development cycle, most markets have significant scope for additional development activity.

MAJOR CITY SUPPLY GROWTH PERFORMANCE AND FORECASTS TO FY2026 – ROOMS

Average Room Rate

Long term rate growth expectations averaging 3.7% p.a are expected, buoyed by very strong occupancy levels for the entirety of the forecast.

Highlights include:

• Our rate growth expectations have reduced slightly following increased supply expectations which will affect occupancy pressure, as well as discounting behaviour as an increased number of properties look to establish market share; and

• Upside opportunity remains in many cities, particularly if the large Market Response supply allowances forecast do not eventuate as quickly as expected.

Transactions Trends

Diminished stock availability is reducing hotel asset sales volumes despite considerable domestic and international appetite to acquire. This reduction in the sale of “second hand” hotels is supported by the increased desirability of the asset class, with sitting investors and new developers wanting to retain hotels as a preferred asset class. Capital allocation has been transferring from existing assets to new build, with over 200 hotels in the pipeline. This is seeing significant new investment that is placed in the supply pipeline rather than transaction volumes.

To receive a full copy of Hotel Futures 2018, which includes a city-by-city forecasts for the 10 major Australian Cities, please register at www.dransfield.com.au/publications